智能手机、TWS势微的大环境下,智能手表逆势增长。

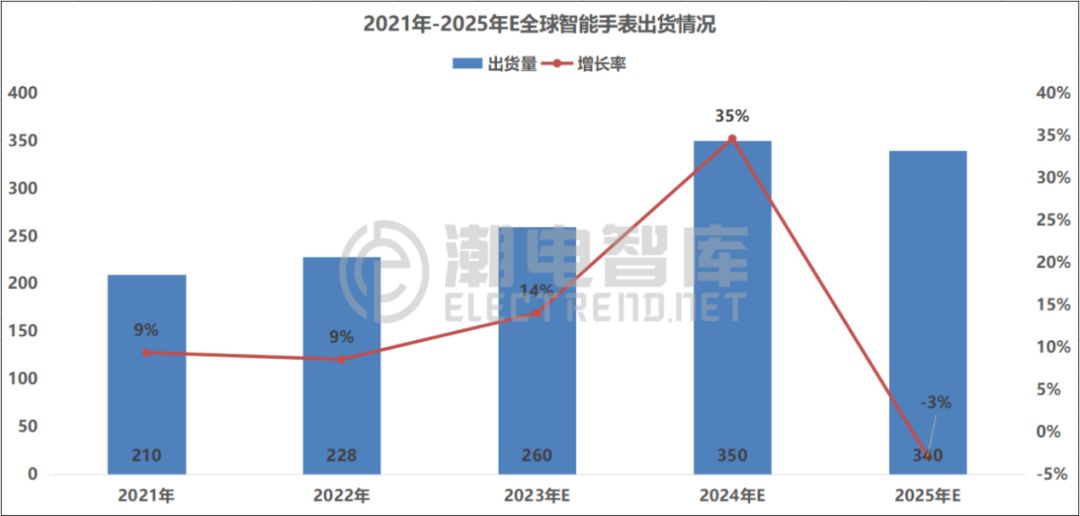

潮电智库统计数据显示,2022年全球智能手表出货量2.28亿只,同比增长9%;预计2023年增速为14%。

>

目前来看,智能手表领域还未形成标准化,产品在功能应用端存有充足的创新空间,至少未来两年将会延续向上增长态势。

根据潮电智库统计,2022年十大全球智能手表厂商共占全球市场份额达72%。其中,苹果和华为分别以21%和10%的市占率名列一、二。

以出货量、市场份额、产品结构、在售款数等企业经营关键指标形成综合竞争力,潮电智库认为,2023年全球智能手表厂商的竞争梯队已成型。

其中,苹果、华为、三星位列第一梯队;佳明、Noise、Fire-Boltt、boAt为第二梯队;小天才、华米、小米则为第三梯队。

下面将从出货量、产品结构、在售款数等三大关键要素展开综述。

01出货量

持续上涨的出货量彰显着旺盛的市场需求,产品扩容迭代的空间进一步扩大。

第一梯队的竞争亦十分激烈。相较于上一年,苹果的出货量在上升,但市占率在下降,这意味着市场扩大的情况下,来抢夺蛋糕的高手玩家也增多了。需要指出的是,第一梯队的三位玩家皆为生态大厂,且都有智能手机产品加持,也就是通称的“手机系”。

从去年开始,受惠人口红利,印度跃升至全球最大智能手表市场。Noise、Fire-Boltt、boAt等本土品牌强势崛起,成为第二梯队的代表。

出货量排名位列六、七位的皆着眼于细分赛道,分别是专注于运动板块的佳明和儿童版块的小天才。

02产品结构

从榜单来看,2023年全球智能手表市场有四大“高端玩家”,分别是苹果、华为、三星、佳明,中高端市场有小天才和华米两位玩家,Noise、Fire-Boltt、boAt、小米在中低端市场受到欢迎。

其中,苹果与华为的高端榜首之争越演越烈。

今年2月有消息传出,苹果智能手表在实现无创血糖监测功能方面取得重大突破,并且已经进入概念验证阶段。据产业链专家分析,这一功能主要是针对中国市场需求专门设计。不过同时有报道称,苹果可能还需要额外3-7年时间才能实现将此项技术的硬件缩小到适合Apple Watch大小。

华为自然也不甘示弱。今年3月,华为发布了全新高端旗舰华为WATCH Ultimate,这是全球首款支持双向北斗卫星的大众智能手表。对此,英国知名科技媒体Trusted Reviews评价,“华为WATCH Ultimate将成为Apple WATCH Ultra的克星。”

Noise、Fire-Boltt、boAt虽然合计占据印度七成以上的市场份额,但其对本地消费过高的依赖性,以及中低端产品的市场站位决定它们难以走出印度,因此在市场份额的增长上具有一定局限性。

与此同时,从芯片、显示屏、电池等核心器件供应,以及ODM制造各个环节,印度品牌基本倚仗中国。从这一层面上来看,印度市场更像是中国供应链的“试金石”与掘金地。

03在售款数

从榜单分析,市占率跑速较快的中低端玩家的玩法是多款、低价、跑量。

例如Noise、Fire-Boltt、boAt的在售款数分别是49、68、66,这相当于前三名高端玩家在售款数的8-22倍。

虽然苹果、三星、华为的在售款数不多,但依然赚得盆满钵满,成为各自营收的重要来源。由此可见,高端产品具备更为强大的吸金能力,也是衡量品牌综合竞争力的重要指标。

值得注意的是,此前手环领域的王者小米却异常低调,在智能手表中低端赛道上表现出观望的特点,其在售款数只有4款,市场份额仅为4%。那么,一向以产品款式丰富为特质的小米为什么在中低端赛道上没有重兵投入,是否有走向高端市场的想法?尚待观察。

Top 10 smart watch brands: Apple and Huawei evenly to be NO.1, while XIAOMI is the most mysterious

The smartphones and TWS markets are declinling, while smart watches markets are growing.

According to statistics from Electrend, the global shipment volume of smart watches in 2022 was 228 million, a year-on-year increase of 9%; The expected growth rate in 2023 is 14%.

At present, the field of smart watches has not yet formed standardization, and there is sufficient innovation space for products in functional applications. At least in the next two years, it will continue to grow upwards.

According to statistics from Electrend, the top ten global smartwatch manufacturers accounted for a total of 72% of the global market share in 2022. Among them, Apple and Huawei ranked first and second with a market share of 21% and 10%, respectively.

based on key business indicators such as shipment volume, market share, product structure, and number of models on sale, Electrend believes that the competitive ladder of global smartwatch manufacturers has formed in 2023.

Among them, Apple, Huawei, and Samsung rank in the first tier; Garmin, Noise, Fire Boltt, and boAt are the second tier teams; Okii, Huami, and Xiaomi are the third tier teams.

The following will provide an overview of three key factors: shipment , product structure, and number of products on sale.

1、shipment

The continuously rising shipment volume highlights strong market demand, and the space for product expansion and iteration is further expanded.

The competition in the first tier is also very fierce. Compared to the previous year, Apple's shipment volume is increasing, but its market share is decreasing, which means that as the market expands, there are also more skilled players coming to grab the cake. It should be pointed out that the three players in the first tier are all ecological giants and are all supported by smartphone products, commonly known as the "mobile phone series".

Since last year, thanks to the demographic dividend, India has jumped to the world's largest smart watch market. Local brands such as Noise, Fire-Boltt, and boAt have risen strongly and become representatives of the second tier.

Ranked sixth and seventh in terms of shipment volume, both focus on segmented tracks, namely Jiaming, who focuses on the sports sector, and Little Genius, who focuses on the children's sector.

2、Product Structure

From the list, there are four "high-end players" in the global smartwatch market in 2023, namely Apple, Huawei, Samsung, and Jiaming. In the mid to high end market, there are two players: Xiaotian and Huami. Noise, Fire Boltt, boAt, and Xiaomi are popular in the mid to low end market.

Among them, the competition for high-end top spot between Apple and Huawei is becoming increasingly fierce.

In February this year, it was reported that Apple's smart watch had made a major breakthrough in realizing the non-invasive blood glucose monitoring function, and had entered the proof of concept stage. According to the analysis of industry chain experts, this function is mainly designed specifically for the needs of the Chinese market. However, there are also reports that Apple may need an additional 3-7 years to achieve the hardware reduction of this technology to fit the Apple Watch size.

Huawei is naturally not willing to be outdone. In March of this year, Huawei released its new high-end flagship Huawei WATCH Ultimate, which is the world's first Volkswagen smartwatch that supports bidirectional Beidou satellites. Regarding this, the well-known British technology media Trusted Reviews commented, "Huawei WATCH Ultimate will become the nemesis of Apple WATCH Ultra.

Although Noise, Fire Boltt, and BoAt collectively occupy over 70% of the market share in India, their high dependence on local consumption and the market position of mid to low-end products make it difficult for them to exit India, so they have certain limitations in increasing market share.

At the same time, Indian brands rely heavily on China for the supply of core components such as chips, displays, batteries, and various aspects of ODM manufacturing. From this perspective, the Indian market is more like a touchstone and gold digger for China's supply chain.

portant;">

portant;">3、Number of models for sale

From the analysis of the list, the gameplay of mid to low-end players with fast market share is multiple options, low prices, and running volume.

For example, the number of models on sale for Noise, Fire Boltt, and BoAt is 49, 68, and 66, respectively, which is equivalent to 8-22 times the number of models sold by the top three high-end players.

Although Apple, Samsung, and Huawei have a small number of models on sale, they still make a lot of money and become important sources of revenue for each company. From this, it can be seen that high-end products have a stronger ability to attract money and are also an important indicator to measure the comprehensive competitiveness of a brand.

It is worth noting that Xiaomi, the previous king in the field of bracelets, has been exceptionally low-key and has shown a wait-and-see characteristic on the low-end track of smart watches. It has only four models on sale and a market share of only 4%. So, why hasn't Xiaomi, which has always been characterized by rich product styles, invested heavily in the mid to low end track? Do they have the idea of moving towards the high-end market? It remains to be observed.