光伏产业的成熟,以及经济性价值被不断挖掘,导致逆变器出货呈现明显上升趋势。

今年上半年,海内外光伏装机需求高速增长,组件、逆变器等光伏电站核心部件维持较高出口增速。根据潮电智库统计,2023年1-5月逆变器出口接近2500万台,同比增长45.2%。

从市场格局看,中国光伏逆变器行业呈现充分竞争态势,市场集中度高,龙头企业受益明显。其中阳光电源、华为的出货量排名前二,为行业第一梯队;古瑞瓦特、锦浪科技、上能电气、固德威四家企业市占率集中在6%-8%区间,为第二梯队企业。

潮电智库获悉,光伏逆变器产品生命周期一般约为10-15年。预计2022-2026年,光伏逆变器行业整体规模将保持持续增长态势。

不仅如此,潮电智库认为,储能将成为打开逆变器市场的第二把钥匙。

储能是大规模发展可再生能源的关键支撑,对新能源的利用具有重大意义,是能源革命的重要环节。储能逆变器可以控制储能电池组的充电和放电过程,进行交直流的变换,是储能系统中的必要环节,占比储能系统成本约15%。

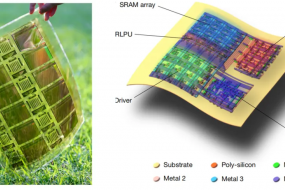

以下沉产业链为根基,潮电智库特选出逆变器行业十大明星产品进行拆解,旨在通过展现当前逆变器核心结构件及成本占比组成,为中国供应链找到更准确的商机落点。

本期率先登场的主角,为阳光电源的光伏并网逆变器SG125HV。

光伏并网逆变器是光伏发电系统中必不可少的关键部件,主要应用在太阳能光伏发电领域的专用逆变电源,并网逆变器将太阳能电池板产生的交流电通过电力电子转换技术变换为能够直接划入电网的交流电。

从产品应用来看,光伏并网逆变器不仅具有直交流变换功能,还能最大限度地发挥太阳电池性能和系统故障保护。归纳起来有自动运行和停机、最大功率跟踪控制、防单独运行、自动电压调整、直流检测、直流接地检测等多重功能。

阳光电源SG125HV额定功率125kW,是全球首款功率超过100kW的组串逆变器,重量仅为60kg。

通过产业链调研所得,阳光电源SG125HV除了电感,其余主要器件均由海外强企供应。其中IGBT以15%的成本占比位居第一,电感、MOSFET、MCU主控芯片、散热器的器件的成本也超过了10%。

国内某一线储能厂商高管对潮电智库表示,因为产品出口涉及到认证层面,当前中国企业想进入一线供应链的难度较大,但未来的替代空间非常广阔。

值得注意的是,乘储能兴起东风,阳光电源(300274.SZ)近年来连续实现经营业绩大涨。2022年,公司实现营收 402.57 亿元,同比增长 66.79%;净利润35.93 亿元,同比增加 127.04%。

据6个月内累计共35家机构预测,2023年阳光电源净利润均值为69.75亿元,将较去年同比增长94.1%。

SunGrow Photovoltaic Grid-Tie Inverter SG125HV Disassembly: Core components sourced from overseas suppliers, with IGBT accounting for the highest proportion of total cost

The photovoltaic industry has matured, and its economic value is continuously being explored, leading to a noticeable increase in the shipment of inverters.

In the first half of this year, both domestic and overseas photovoltaic installation demands have grown rapidly, with core components such as modules and inverters maintaining a high export growth rate. According to data from the Chaodian , the export volume of inverters reached nearly 25 million units from January to May 2023, with a year-on-year growth of 45.2%.

From the market perspective, the Chinese photovoltaic inverter industry shows a state of full competition, with a high market concentration, and leading companies have benefited significantly. Among them, SunGrow Power and Huawei ranked first and second in terms of shipment volume, making them part of the top-tier enterprises. GROWATT, JNTech, Sungrow Power Supply, and GoodWe are part of the second-tier enterprises, with their market shares ranging from 6% to 8%.

According to Chaodian , the typical product life cycle of photovoltaic inverters is generally around 10-15 years. It is expected that from 2022 to 2026, the overall scale of the photovoltaic inverter industry will continue to grow.

Furthermore, Chaodian believes that energy storage will become the second key to unlock the inverter market.

Energy storage is a crucial support for the large-scale development of renewable energy and plays a significant role in utilizing new energy. It is an essential part of the energy revolution. Energy storage inverters can control the charging and discharging process of energy storage battery packs and perform AC-DC conversion, making them a necessary component of energy storage systems, accounting for approximately 15% of the total cost of such systems.

based on the sinking industrial chain, Chaodian has seleced the top ten star products in the inverter industry for disassembly, aiming to showcase the current core structure components and cost proportions. This will help to identify more accurate business opportunities for China's supply chain.

In this issue, the first protagonist to be showcased is SunGrow Power's photovoltaic grid-tie inverter SG125HV.

The photovoltaic grid-tie inverter is an essential component in photovoltaic power generation systems, mainly used as a dedicated inverter power supply in the field of solar photovoltaics. The grid-tie inverter converts the AC power generated by solar panels into AC power that can be directly fed into the grid through power electronic conversion technology.

In terms of product applications, the photovoltaic grid-tie inverter not only has the function of AC-DC conversion but also maximizes the performance of solar cells and system fault protection. It includes multiple functions such as automatic operation and shutdown, maximum power tracking control, anti-isolated operation, automatic voltage adjustment, DC detection, and DC ground detection.

SunGrow Power's SG125HV has a rated power of 125 kW and is the world's first series inverter with a power exceeding 100 kW, weighing only 60 kg.

According to research on the industrial chain, except for the inductor, all other main components of SunGrow Power's SG125HV are supplied by overseas strong enterprises. Among them, IGBT ranks first with a cost proportion of 15%, while the cost of components such as inductors, MOSFETs, MCU control chips, and heat sinks also exceeds 10%.

An executive from a leading domestic energy storage company stated to Chaodian that because product exports involve certification aspects, it is currently challenging for Chinese companies to enter the first-tier supply chain. However, there is a broad future space for substitution.

It is worth noting that with the rise of energy storage, SunGrow Power (300274.SZ) has achieved continuous growth in its operating performance in recent years. In 2022, the company achieved a revenue of 40.257 billion yuan, a year-on-year increase of 66.79%, and a net profit of 3.593 billion yuan, a year-on-year increase of 127.04%.

based on forecasts from 35 institutions within the past six months, the average net profit of SunGrow Power for 2023 is estimated to be 6.975 billion yuan, representing a year-on-year increase of 94.1%.